The Ppp Financial Model

PPP projects are generally financed using project finance, of which there are numerous articles on this blog. It should be noted that project finance models are very complex, and PPP models are no different.

A PPP financial model looks to address the following key factors:

- Is the public sector getting value for money should they be relying on the private sector or would they get better value for money by doing the project themselves?

- What is the economic and commercial feasibility of the project? Can the government rely on the private sector party to operate and maintain the infrastructure asset?

- How does the new project compare in cost to similar operating infrastructure assets or projects?

- Can the public afford to use the asset since it is being built for their benefit?

- What is the initial cost and ongoing life-cycle cost for the public sector?

Ppp Meaning And Theory Explained To Beginners

Before we identify the PPP meaning, we need to figure out what is PPP. The abbreviation stands for purchasing power parity. It is a popular economic theory that makes it possible to evaluate and compare the economic health of two separate countries. In other words, the theory comes as a tool to perform in-depth economic analysis based on specific insights and financial data. The PPP theory in economics can be of different types depending on the way it is applied to the financial market.

In this article, we will define what PPP means as well as how to use the theory of purchasing power parity when trading different assets.

What Is The Relationship Between Ppp And Gdp

Purchasing power parity is one of the most common metrics used to measure gross domestic product which is the total market value of goods and services produced in a country within a given period. Each country has to record and report its own data, which is then compared to other countries to assess economic performance.

The alternative metric to GDP by PPP is nominal GDP, which simply takes a countrys exchange rate and converts the GDP value. However, there are two issues with doing this: exchange rates are volatile, and exchange rates only measure traded goods. Using volatile forex rates alone doesnt account for the fact that although each currency fluctuates in value changing how a countrys GDP compares to others the living standards in the country might not change. The exchange rate doesnt look at living situations and non-traded goods, such as the price of getting the train, housing or getting a haircut. It only impacts goods that are exchanged across borders, rather than domestically.

Due to the large differences in price levels between developed and developing economies, it might not be enough to simply countries market rate converted GDP. This is why using GDP by PPP has become a popular metric.

The assumption here is that tradable goods are more closely aligned with nominal exchange rates, while non-tradeable goods and services are closer to the PPP rate.

Don’t Miss: How Can I Find My Biological Mom

How To Use Purchasing Power Parity

On a macroeconomic level, the PPP measurement is used to compare economic productivity and living standards between countries as we have seen above, it is most commonly used to adjust GDP. However, there are so many other ways that individuals and institutions can use PPP to interpret socioeconomic data. These include assessing contributions to carbon emissions, measuring global poverty and even predicting financial markets.

The World Bank states that the GDP measure more accurately compares the volume of activity and production of a country to another,3 which is why it uses the metric to look at the relationship between economy and carbon emissions.

PPP data is also commonly used to measure global poverty. Analysts use global PPP data to assess how changing price levels impact the number of individuals below the poverty line, and readjust the global estimates of how long it will be until poverty ends. In 2011, the PPP adjusted poverty line was set at $1.90 per day indicating that anyone who earns less than this globally is considered to be in extreme poverty.

Who Owns The World Bank

No person, organization, government, or nation owns the World Bank. It is an organization made up of member countries, represented by a Board of Governors. This Board governs the organization, creates policies, and appoints executive directors. The executive directors govern the Bank’s business and budget, and grant loan approvals. The president and managers manage the day-to-day operations.

You May Like: What Does M Stand For In Physics

A Brief Numerical Look

For the numerical work to be reported here, we used the most recent data on the 28 EU nations assembled by Sustainable Development Solutions Network and Institute for European Environmental Policy See European Commission, Eurostat Sustainable development in the European UnionMonitoring report on progress toward the SDGS in an EU context2020 edition.

With data for only 28 nations, it is necessary to limit the number of SDG indicators. We decided to pick as diverse SDGs as possible, representing both human life characteristics, social conditions, and climate and environmental concerns.

Table 1.1 lists GDP and six SDG indicators, for each EU nation as follows:

Table 1.1. Actual practice = best practice for 17 Pareto optimal EU nations. SDG10 and SDG13 measured in their original unadjusted scales. Only one decimal shown here.

| GDP |

|---|

The mathematics of the multidimensional methods employed in the present book has already been briefly characterized, culminating in the text box Fig. 1.1. One additional observation should be made. These methods allow for two alternative index calculations to be made: one assuming constant returns to scale , the other assuming only variable returns to scale. For the present, we decided to choose the latter alternative, permitting a closer fit when the number of observations is limited. See Chapter 2.

Donald W. Jones, in, 2004

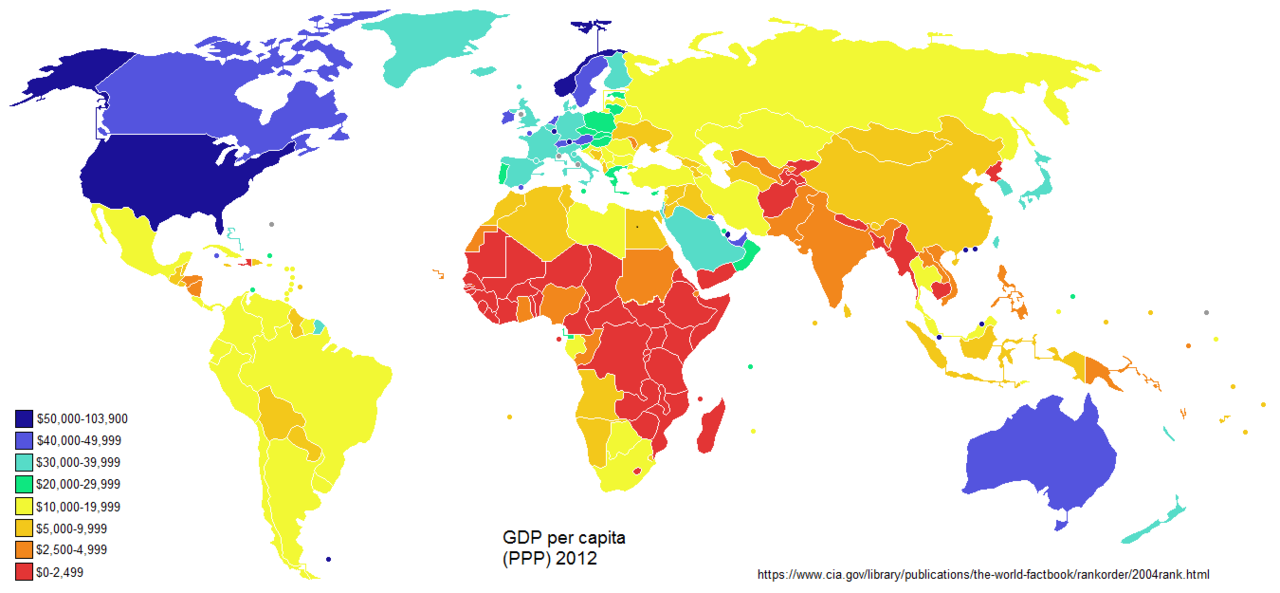

What Is The Ppp By Country

Purchasing power parity is a comparison between two countries currencies, so the PPP of a country will vary depending on which other country and currency youre comparing it to.

Organizations like the World Bank regularly publish lists of countries GDP, adjusted for PPP. Usually, the US dollar is the base currency for these lists because its the worlds most popular reserve currency. Sometimes, the figures are listed in international dollars, which is really another way of measuring against the US dollar.

According to the World Bank, as of 2018, the top 10 countries by GDP adjusted for PPP were:

This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security. This information is not a recommendation to buy, hold, or sell an investment or financial product, or take any action. This information is neither individualized nor a research report, and must not serve as the basis for any investment decision. All investments involve risk, including the possible loss of capital. Past performance does not guarantee future results or returns. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy.

1771482

Also Check: How Does France’s Geography Affect Its Economy

Definition And Examples Of Purchase Power Parity

The purchasing power parity calculation tells you how much things would cost if all countries used the same currency. In other words, it is the rate at which one currency would need to be exchanged to have the same purchasing power as another currency. Purchasing power parity is based on an economic theory that states the prices of goods and services should equalize among countries over time.

- Acronym: PPP

International trade allows people to shop around for the best price. Given enough time, this comparison shopping allows everyone’s purchasing power to reach “parity,” or equalization.

Parity is tedious to compute. A U.S. dollar value must be assigned to everything. That includes items not widely available in America. For example, there aren’t too many ox carts in the United States. Also, it is doubtful that the cart’s U.S. price would accurately describe its value in rural Vietnam, where it’s needed to grow rice.

The World Bank computes PPP for each country in the world. It provides a map that shows the PPP ratio compared to the United States.

For many developing countries, the PPP is estimated using a multiple of the official exchange rate measure. For developed countries, the OER and PPP measures are more similar because the standards of living in developed countries are closer to those of the United States.

How Does Ppp Theory Work

Why would one ever need to use the PPP theory? Well, that depends on specialization. Economists would rather apply it to compare and contrast:

Additionally, the rate can make great use for shares and bondholders or investors, as they will be able to predict fluctuation. Besides, this will work for currency traders whenever they need to indicate the weakness of the particular currency.

You May Like: What Subjects Do I Need To Study Psychology

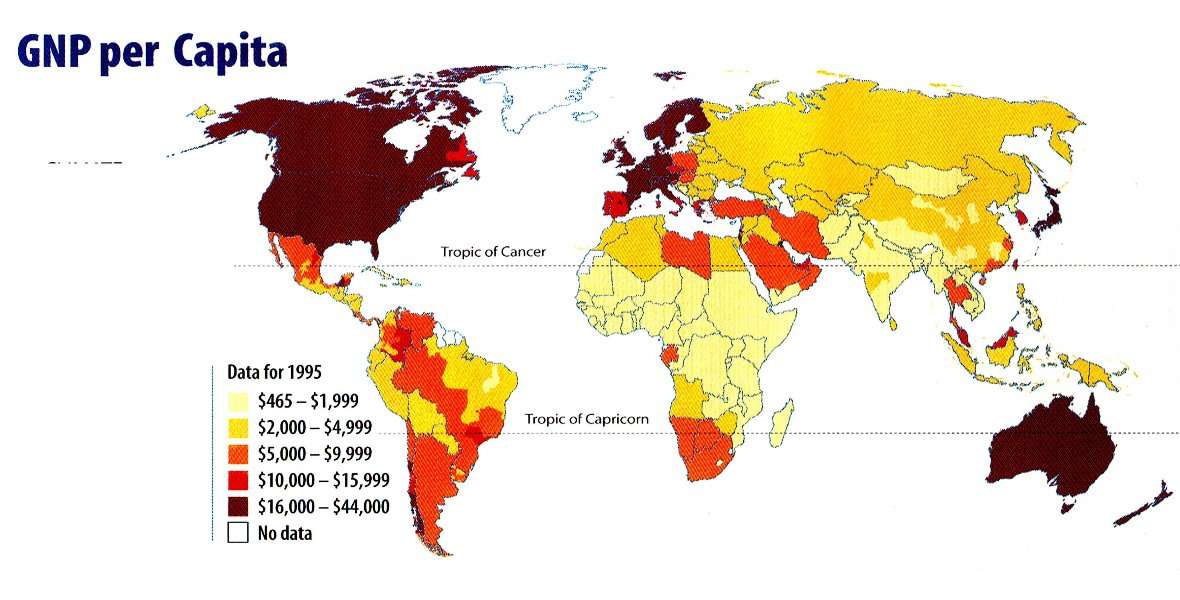

What Is The Connection Between Gni And Ppp

Gross National Income and Purchasing Power Parity can be closely related, as GNI may be expressed in terms of PPP for comparison purposes. This GNI and PPP adjustment allows viewers to generalize financial declarations on an international scale, so they better understand metrics from different countries. Numerous organizations maintain frequently updated references on the GNI of various nations around the world, adjusted by PPP for convenience. The GNI and PPP connection is important to consider when looking at these documents.

To calculate GNI, analysts look at the total value of goods and services produced within a given time period, such as a year. It is very similar to the Gross Domestic Product , which measures the same characteristics. With the GNI, however, analysts also evaluate things produced overseas that add value to the nation, looking at what residents produce regardless of where its located. Thus, products made in Africa for a company based in Britain would be part of Britains GNI.

Ever since she began contributing to the site several years ago, Mary has embraced theexciting challenge of being a SmartCapitalMind researcher and writer. Mary has a liberal arts degree from Goddard College andspends her free time reading, cooking, and exploring the great outdoors.

Purchasing Power Parity And Forex

Traders can use any disparity between the PPP rate and exchange rate to assess a currencys long-term forecast and valuation. It is possible to use the rates to predict the direction of a currency pair and use it to determine whether to buy or sell a currency pair.

However, it should not be the only measure used due to the limitations of PPP. Economic theories are merely an idea on where the markets could go, but it is vital to use technical and fundamental analysis to gain a more developed view of price movements.

The theory goes that currencies will converge to a point of equilibrium. So, if there is disparity between the exchange rate and PPP rates, then an individual can aim to trade the move toward this central point. If the PPP rate indicates a currency is over-valued compared to another, then a trader would consider going short on the currency in question. While, if the PPP rate shows the currency is under-valued against the USD, they could consider taking a long view of the market.

The PPP theory assumes that a decline in the purchasing power of a currency, caused by factors such as inflation, should equate to an equal fall in the exchange rate.

The Organisation for Economic Cooperation and Development releases annual PPP data some traders will use these figures to assess the value of each currency against the US dollar, making judgements about the overall trend for that following year.

Recommended Reading: Algebra 1 Test 3 Answers

What Is The Big Mac Index

Marcus Reeves is a writer, publisher, and journalist whose business and pop culture writings have appeared in several prominent publications, including The New York Times, The Washington Post, Rolling Stone, and the San Francisco Chronicle. He is an adjunct instructor of writing at New York University.

The Big Mac index is a survey created by The Economist magazine in 1986 to measure purchasing power parity between nations, using the price of a McDonald’s Big Mac as the benchmark.

Purchasing power parity is an economic theory which states that exchange rates over time should move in the direction of equality across national borders in the price charged for an identical basket of goods. In this case, the basket of goods is a Big Mac.

Big Mac Index

Public Private Partnerships Leveraging Private Sector Investment And Capital To Deliver Public Infrastructure

If you have ever worked in project finance, you have probably heard of a Public-Private Partnership, or PPP. What is this so-called partnership, and how does it work to deliver infrastructure to the public?

Even if you have not worked in infrastructure finance, you have also likely heard of the infrastructure gap, or the limited supply of funding for infrastructure projects. I personally think a bigger issue is the lack of bankable infrastructure projects but that is a personal view and certainly, limited funding is an issue. PPPs aim to address this by allowing private investment in what would typically be public infrastructure such as public transport, hospitals, prisons and even government buildings. Often the core services will still be provided for or organised by government, such as border police and officers, teachers or doctors and nurses.

The following illustration from New Zealand Social Infrastructure Fund Limited shows how a PPP works, with a public sector client and a private entity who finances, designs, builds, maintains and operates the infrastructure. Debt providers can range from investment banks to DFIs.

You May Like: How Did Geography Impact The Development Of Agricultural Societies

What Is The World Bank

The World Bank is an international organization dedicated to providing financing, advice, and research to developing nations to aid their economic advancement. The bank predominantly acts as an organization that attempts to fight poverty by offering developmental assistance to middle- and low-income countries.

As of 2022, the World Bank identified 17 goals that it aims to achieve by 2030. The top two are stated in their mission statement. The first is to end extreme poverty by decreasing the number of people living on less than $1.90 a day to below 3% of the world population. The second is to increase overall prosperity by increasing income growth in the bottom 40% of every country in the world.

Trends In Energy Intensity And Consumption Per Capita

As mentioned previously, energy consumption in Africa is among the world’s lowest, although energy intensity is relative high. Despite the low base, primary energy consumption per capita has increased by less than 1% per year during the past two decades . At the same time, energy intensity has actually increased, so African countries need more energy to produce $1 of GDP . This is true even considering the purchasing power parity difference between Africa and the rest of the world. Data for the continent, however, obviously hide vast differences between countries .

Figure 11. Energy consumption per capita in Africa.

Figure 12. Energy intensity trends in Africa .

Figure 13. Energy intensity in African countries .

Although a number of African countries have included energy efficiency as part of their national energy policies, few have taken concrete steps toward legislation or specific programs and measures to promote it. Only Tunisia and Ghana have implemented mandatory appliance standards, whereas South Africa is implementing a mandatory commercial building code and has a voluntary residential building energy guideline. Ghana has created an independent body with multistakeholder support called the Energy Foundation, which has been highly successful in implementing energy efficiency programs in a range of sectors. Egypt is also considering a similar path and has set up an energy efficiency council to help develop a national energy efficiency strategy.

Also Check: What Is Visual Overlap In Math

Range And Quality Of Goods

The goods that the currency has the “power” to purchase are a basket of goods of different types:

The more that a product falls into category 1, the further its price will be from the currency exchange rate, moving towards the PPP exchange rate. Conversely, category 2 products tend to trade close to the currency exchange rate. .

More processed and expensive products are likely to be tradable, falling into the second category, and drifting from the PPP exchange rate to the currency exchange rate. Even if the PPP “value” of the Ethiopian currency is three times stronger than the currency exchange rate, it won’t buy three times as much of internationally traded goods like steel, cars and microchips, but non-traded goods like housing, services , and domestically produced crops. The relative price differential between tradables and non-tradables from high-income to low-income countries is a consequence of the BalassaâSamuelson effect and gives a big cost advantage to labour-intensive production of tradable goods in low income countries , as against high income countries .

PPP calculations tend to overemphasise the primary sectoral contribution, and underemphasise the industrial and service sectoral contributions to the economy of a nation.

Pairing Purchasing Power Parity With Gross Domestic Product

In contemporary macroeconomics, gross domestic product refers to the total monetary value of the goods and services produced within one country. Nominal GDP calculates the monetary value in current, absolute terms. Real GDP adjusts the nominal gross domestic product for inflation.

However, some accounting goes even further, adjusting GDP for the PPP value. This adjustment attempts to convert nominal GDP into a number more easily comparable between countries with different currencies.

To better understand how GDP paired with purchase power parity works, suppose it costs $10 to buy a shirt in the U.S., and it costs 8.00 to buy an identical shirt in Germany. To make an apples-to-apples comparison, we must first convert the 8.00 into U.S. dollars. If the exchange rate was such that the shirt in Germany costs $15.00, the PPP would, therefore, be 15/10, or 1.5.

In other words, for every $1.00 spent on the shirt in the U.S., it takes $1.50 to obtain the same shirt in Germany buying it with the euro.

Read Also: What Are Growth Factors In Biology