Measurements Of Region And Global Disparities

Project/Awareness:Poverty in our local community. Key termsInfant mortality rateEducation

- school enrolment

| World literacy rates | The Education For ALL Development Index is a composite index using four of the six EFA goals |

Nutrition

- The hours of work needed to feed a family of five increased by 10-20%

- 50 million women or 40% of pregnant women in developing countries are anemic.

| Daily Calorie Intake per capita | World bank data on the precentage of population that is undernourished per country. |

Human Development Index Human development index : HDI was developed in 1990 and is used by the United Nations to measure levels of development, HDI looks at three variables:

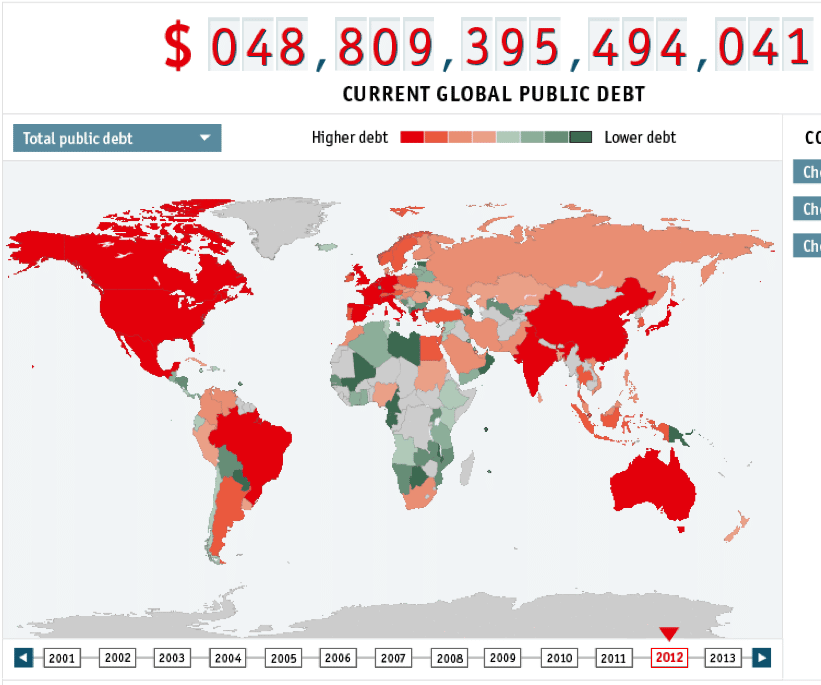

The HDI calculations score all countries between 0 and 1. The map below shows that according to HDI the most developed countries are in Western Europe North America and Australia while the least developed countries are in Central Africa.HDI is what is known as a composite measure. This simply mean that more than one variable is taken into account, for HDI three variables are looked at. It can be harder to collect all the data for composite measures, but they do give a more complete and accurate picture of a country’s are area’s development.Examine the HDI data from the UNPD Compare the graphs and describe the distribution on the map. |

Problems and Limitations of Development Indicators

How Debt Relief Works

In a number of situations, debt relief may be the only course of action in order to avoid bankruptcy. If a massive debt load makes it difficult to service borrowings, for example, creditors may be amenable to restructuring the debt and providing relief rather than risk the borrower defaulting on its obligations and increasing overall credit risk. Refinancing a mortgage to a lower interest rate is one straightforward example of debt relief.

Another common form of debt relief involves debt consolidation, or the combining of several higher-interest loans into a single lower-interest loan. There are several ways consumers can lump debts into a single payment. One method is to consolidate all their credit card payments into one new credit card, which can be a good idea if the card charges little or no interest during an introductory period. They may also utilize an existing credit cards balance transfer feature .

Home equity loans and home equity lines of credit are another form of consolidation sought by some people. Usually, the interest for this type of loan is deductible for taxpayers who itemize their deductions. There also are several options available from the federal government for people who want to consolidate their student loans.

Stage : Repatriation Of Profits

| What | |

| To return something, especially money or profit, to the country of its owner or its origin | |

|

Imagine if U.S. companies could add well over $1 trillion to their U.S. coffers in an instant without having to sell a subsidiary, issue a single share, or incur a penny of debt. Cisco Systems has an estimated $30 billion in cash outside the U.S. |

|

| Importance | |

| There are 63,000 transnational corporations worldwide, with 690,000 foreign affiliates. Three quarters of them are based in North America, Western Europe and Japan. Ninety-nine of the 100 largest transnational corporations are from the industrialized countries. Royal Dutch Shell’s revenues are greater than Venezuela’s Gross Domestic Product. Using this measurement, WalMart is bigger than Indonesia. General Motors is roughly the same size as Ireland, New Zealand and Hungary combined. |

Recommended Reading: What Do Biology Teachers Do

Is Debt Relief Legitimate

The concept of debt relief is absolutely legitimate and there are numerous legitimate debt relief companies out there. However, there are also plenty of scam companies around that will promise to help you, accept whatever fee you pay them, but leave you saddled with the debt and doing none of the work that was promised.

Again, remember it is illegal for them to ask for a fee upfront. Check The Better Business Bureaus Scam Tracker for scams if youre looking into any kind of debt relief company.

How Long Does It Take To Recover Financially From Debt Settlement Or Debt Consolidation

Any effects from your debt settlement or consolidation can remain on your credit report for a maximum of seven years, but some of these effects wont even last that long if youre taking care of your credit health. For example, if you elect to go with debt consolidation and close your credit cards upon payoff, then continue to make your monthly payments without fail, your payment history will stay steady and youll have the chance to open and build new accounts over the years.

Granted, you dont want to just immediately open new credit cards and build up more debt, but it wouldnt hurt to get a gas card or a store card here and there for the sake of credit history.

In the case of debt settlements, however, there are a couple of options available if youre willing to put in a little extra work. Because those late payments and collections accounts are high impact factors and can stay on your credit report for the full seven years, you may want to consider contacting the debtors involved once your accounts have been settled.

Visit Our List of Best Debt Relief CompaniesGet a Free Consultation

Also Check: What Does Integrated Math Mean

Stage : Revise The ‘developed Core Areas And The Peripheries’

| GDP per capita, purchasing power parity |

| The United Nations Human Development Index rankings for 2009 |

| What | |

| Money borrowed from the International Monetary Fund, World Bank or private organizations with the aim of aiding development projects. The loaned money needs to be invested wisely to get a return to service the debt. Interest repayment rates can fluctuate with the global economic markets. | |

|

Ghana learned it was to get a $600m three-year loan from the International Monetary Fund , amid concerns about the impact of the recession on poorer countries. The country needs funds to reduce its budget deficit and support its currency, after being hit by high food and fuel prices. |

|

| Importance | |

|

The IMF gave the go-ahead for a $741m loan to Iraq. The money is part of a previously agreed $3.7bn loan programme designed to help the country rebuild its ravaged infrastructure. Iraq relies on oil revenues for as much as 90% of its income and needs funds to rebuild after years of conflict and insurgency following the 2003 US-led invasion. |

How Does Debt Relief Affect Your Credit

Debt relief has the potential to affect your credit reports and credit scores, although the actual impact depends on which option you choose and where your credit score was to start.

With debt settlement, you may need to be several months behind on payments in order to negotiate a payoff agreement. Most of the damage to your credit may already have been done, as late payments can be detrimental to your score.

A debt management plan may have a minimal impact on your credit if your creditors continue to report the account as paid as agreed. Credit counseling may have no impact on your credit at all. It could even help to raise your credit score if youre able to reduce debts and make payments on time after working out a repayment plan.

Before opting in to any type of loan or credit card relief plan, read the fine print first to check for any mention of credit score impacts. Its also helpful to monitor your credit reports and scores regularly to detect any changes to either one.

Also Check: Is Anthrax Biological Or Chemical

Imf Debt Relief Complemented By Other Sources

About 44 percent of the funding comes from the IMF and other multilateralinstitutions, and the remaining amount comes from bilateral creditors.

The total cost of providing assistance to the 39 countries that have been found eligible or potentially eligible for debt relief under the enhanced HIPC Initiative is estimated to be about $76 billion in end-2017 net present value terms.

The IMFs share of the cost is financed by bilateral contributions and resources from the Fund itself, mainly investment income on the proceeds from off-market gold sales in 1999. These funds were deposited to the IMFs PRG-HIPC Trust.

Resources available in the trust are currently insufficient to finance the cost of debt relief to the remaining two countries with arrears to the IMF which have met the initial conditions for debt relief and reached the decision point. The original financing plan did not include the cost of debt relief to Sudan and Somalia. In December 2019, the IMF Executive Board approved a financing plan that will help mobilize the resources needed for the IMF to cover its share of debt relief to Somalia. As Sudan has made tangible progress towards the decision point, there is an urgent need to mobilize resources. Eritrea is also eligible tor HIPC debt relief but does not have financial obligations to the IMF.

Xi Jinping Wraps Up Africa Trip In Congo

Many Chinese firms employ large numbers of local workers but wages remain low. However, there is evidence that workers are learning new skills because of the availability of Chinese-funded work. Taking advantage of low labour costs, the Chinese are also building factories across Africa. Most African countries now have a growing trade deficit with China, in spite of favourable tax-free trading agreements. Ethiopian exports to China reached $132m in 2006, a figure dwarfed by the value of Chinese imports of $432m .

Read Also: What Can I Do After Psychology Degree

Does Debt Settlement Or Consolidation Ruin Your Credit

Both options can negatively impact your credit. There are numerous factors that impact your credit score, some of which are payment history, number of accounts, age of credit accounts, and derogatory marks. All of these are likely to be affected by debt relief programs, though some will have more impact than others.

Debt settlement companies will require you to let your accounts get severely past due, which will drastically lower the payment history part of your score. This is one of the factors with the highest impact on your credit score, so this should be a last resort .

Additionally, its possible that choosing this route may lead to accounts going into collection, which count as derogatory remarks. Now, a successful debt settlement will reflect that those accounts were settled , but the mark will remain on your account for up to seven years.

Debt consolidation companies often require you to close the credit cards that you pay off using the consolidation loan. It makes sense, given that the idea is to free you of credit card debt permanently, but closing down your cards can damage your credit score in a couple of different ways.

How Do I Know If Debt Settlement Is Right For My Situation

Ultimately, debt settlement ought to be your last option. When youre unable to pay your monthly minimums, have no options available for refinancing or consolidating your debt through a personal loan, and dont have a way to catch up on your payments, debt settlement can keep you from having to file for bankruptcy.

If youre able to utilize a different method to pay down your debts, you should try to do so before attempting to work with a debt settlement company.

Debt settlement can seem like an easier way out than other options. After all, you dont pay your monthly minimums and your debt is cut into a fraction of its original amount. However, as explained above, opting for debt settlement can negatively impact your credit score in several ways.

Those missed minimum payments are recorded in your payment history and remain there for up to seven years, damaging your percentage of on-time payments. Paying less than you owe on a balance will damage your credit score quite a bit as well. If you can lower your debts in ways that wont negatively impact your credit score, doing so will help you in the long-term.

That isnt possible for everyone, though, and thats precisely why debt settlement companies exist. Bankruptcy stays on your credit report for a maximum of seven years, and thats a horrible mark against you in the eyes of lenders.

Don’t Miss: Girls Get Curves Geometry Takes Shape

Closing The Development Gap Challenges

Reducing the gap between the world’s richest and poorest countries isn’t an easy ride. There are challenges and obstacles that can drastically impact how the development gap can be reduced. Let’s briefly bullet point some of the factors that could hinder the attempts to reduce this development gap.

- Some countries are more vulnerable to major natural disasters, which can drastically hinder economic development. Many countries are also going to be much worse off as climate change takes hold, making natural disasters more common and more severe aid could be given to help redevelop after a major natural disaster, to only be followed by another, and another…

- Some countries have ongoing conflicts, which can make investment and development much harder.

- Some governments are corrupt, which makes it much less likely for other countries to invest. Some countries are even completely closed off to outside support, such as North Korea.

- Although investment from TNCs into countries brings benefits, inequalities are still a major problem here they exploit workers for cheaper labour, and can often be super harmful to the environment.

- Although tourism has its benefits, it can bring many issues with it .

Global Networks And Flows

Discuss the importance international aid, loans and debt relief, international remittances from economic migrants, illegal flows, such as trafficked people, counterfeit goods and narcotics in the transfer of capital between the developed core areas and the peripheries.

Definitions:Core and periphery: The concept of a developed core surrounded by an undeveloped periphery . The concept can be applied at various scales local, national, regional or global.Capital: Cash or resources used to generate income by investing in a business or a productive venture. In the case of this topic, capital is used in the sense of financial capital that is used to generate wealth.Remittance: Money sent back home by migrants working in a foreign country.Loan: Money borrowed from an individual, government or organization repayable with interest over a specified period of time.Aid: the transfer of resources at non-commercial rates by one country or organization, to another country .Development aid: aid given by governments and other agencies to support socioeconomic programmes and policies in developing countriesDebt: Money owed by a country to another country or private creditor .Outsourcing: The concept of taking internal company functions and paying an outsidefirm to handle themForeign Direct Investment: A firm that owns or controls productive operations in more than one country through foreign direct investment.

1. Development Aid

Aid as key to development

Aid as an obstacle to development

Don’t Miss: What Are Probes In Biology

List Of The Pros Of Debt Relief Programs

1. These programs can help you to get out of debt in a specific amount of time. Debt relief programs are a form of creditor settlement. You will pay back a debt in multiple payments that is typically much less than what you actually owe. The structure of most programs will have you stop paying your creditors until you have saved a specific amount of money. Then you contact them to negotiate paying back the debt in a couple of payments that is much lower than the total amount. Most programs can even structure monthly payments that are affordable to help you get rid of that debt without negatively impacting your current finances.

2. Representatives of the debt relief program negotiate on your behalf. Many people find it difficult to negotiate with their creditors because the first answer they receive is typically not the one they want. It is an ongoing process where failure is always a possibility. When you start working with a debt relief program, then you will gain access to a group of experienced negotiators who have the expertise in dropping the total amount of money that you owe. This advantage takes a lot of the hassle and frustration out of a challenging and stressful situation.

When your application for debt relief is approved by one of these programs, then all of this work is handled on your behalf. You will pay the agency who helped you to negotiate the lower amounts, and then they will send the funds to your creditors.

Measures To Reduce The Development Gap

There are lots of ways that can help to reduce the development gap.

| Investment | Large companies can locate part of their business in other countries. This helps a country to develop as the companies build factories, lay roads and install internetcables. |

| Aid | Aid is when one or more countries give money to other countries. The money has to be spent on things that will benefit the population. |

| Using intermediate technology | Intermediate technology is using equipment and techniques that are suitable for their country of use. Many poorer countries do not have the skills to maintain expensive equipment. Small-scale, basic solutions are usually more appropriate. |

| Fairtrade | Fairtrade is paying producers a reasonable price for the goods that they produce. Many farmers in LICs are paid very low wages. This means that they cannot escape poverty. Fairtrade gives farmers a better chance in life. |

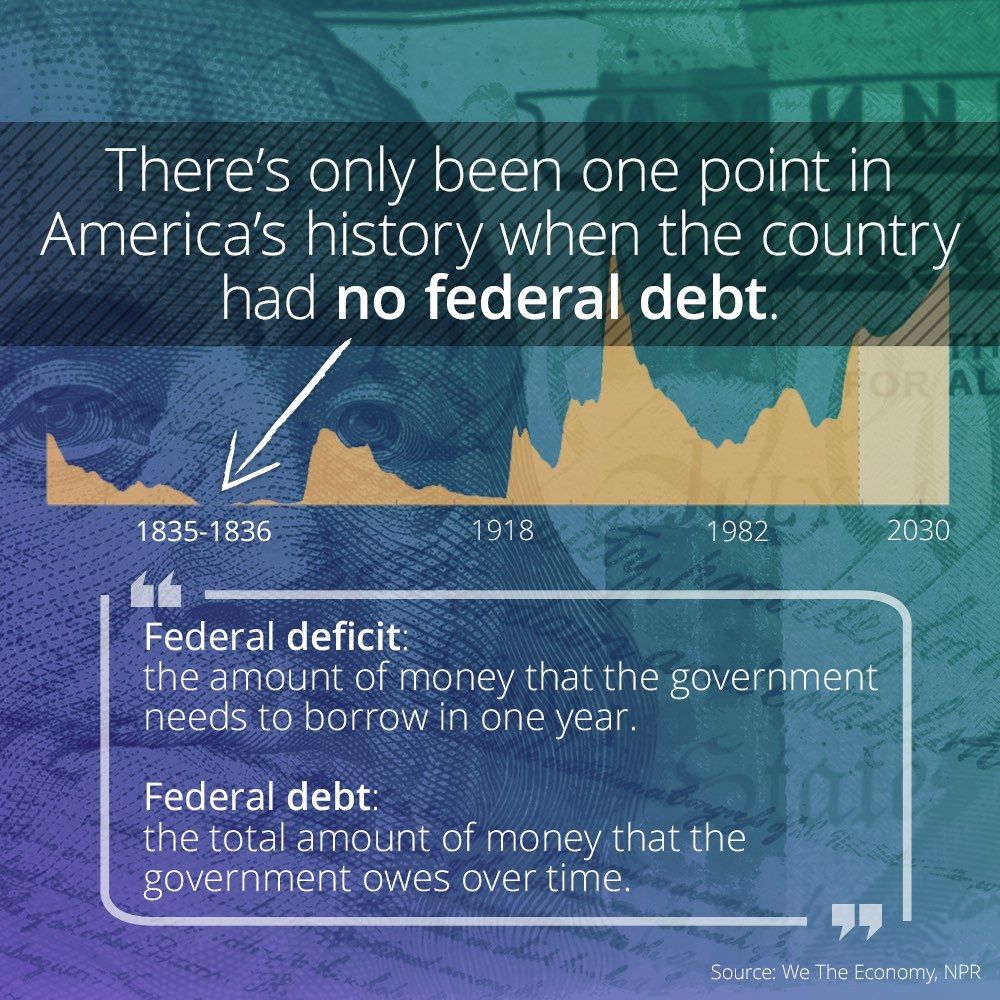

| Debt relief | Many LICs owe money to other countries. Often the repayments and interest are so expensive that indebted countries have no money left to spend on development projects. Debt relief is when debts are either reorganised to make them more manageable, or reduced. |

| Microfinance loans | Microfinance loans are when money is lent to LICs to help them to develop. These are often small loans with reasonable interest rates. They are available to people and businesses who may normally struggle to get credit. |

Read Also: How To Find Tension In Physics